PH SSS Member Loan Application 2015-2026 free printable template

Show details

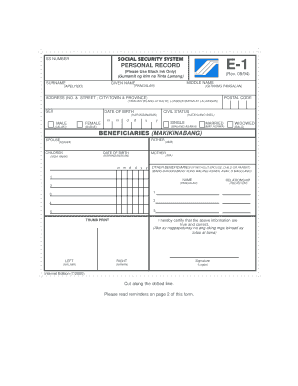

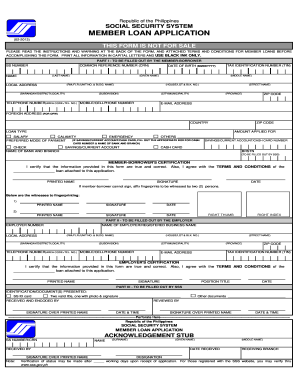

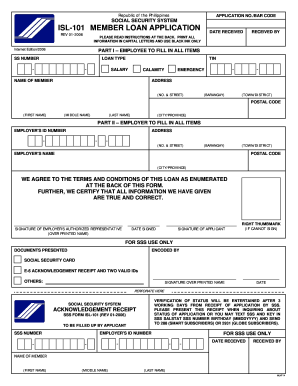

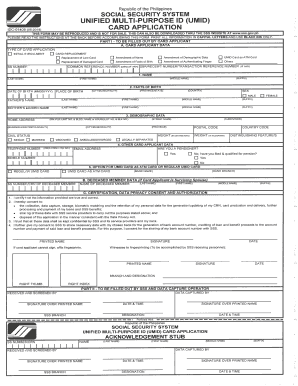

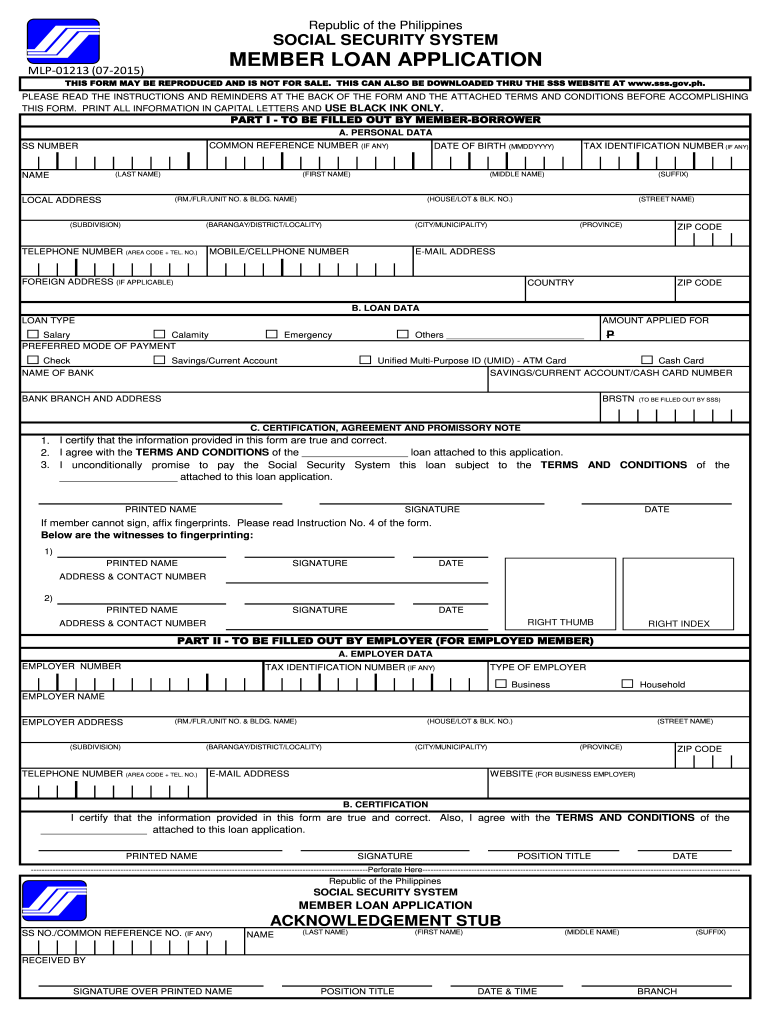

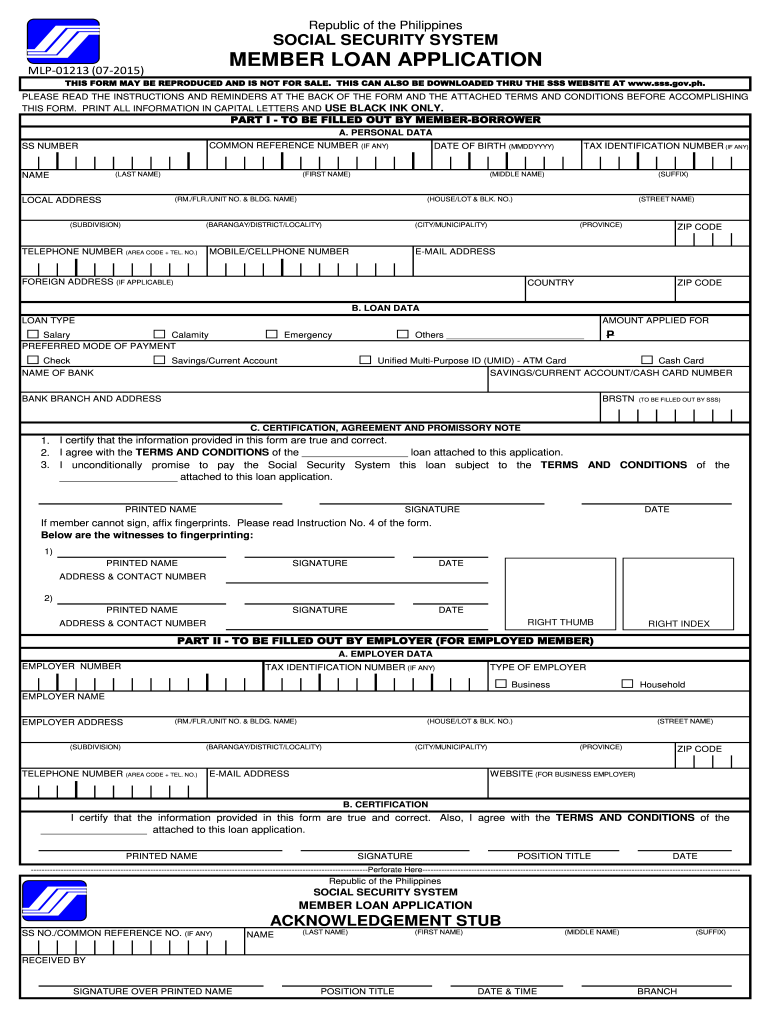

Republic of the Philippines SOCIAL SECURITY SYSTEM MEMBER LOAN APPLICATION MLP-01213 07-2015 THIS FORM MAY BE REPRODUCED AND IS NOT FOR SALE. THIS CAN ALSO BE DOWNLOADED THRU THE SSS WEBSITE AT www. LOAN DATA LOAN TYPE AMOUNT APPLIED FOR Salary Calamity PREFERRED MODE OF PAYMENT Check NAME OF BANK Emergency Others Savings/Current Account P Unified Multi-Purpose ID UMID - ATM Card Cash Card SAVINGS/CURRENT ACCOUNT/CASH CARD NUMBER BANK BRANCH AND ADDRESS BRSTN TO BE FILLED OUT BY SSS C....

We are not affiliated with any brand or entity on this form

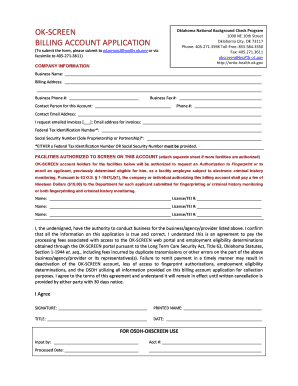

Get, Create, Make and Sign apply for sss loan form

Edit your sss calamity loan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sss online loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sss apply calamity loan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit online sss calamity loan form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH SSS Member Loan Application Form Versions

Version

Form Popularity

Fillable & printabley

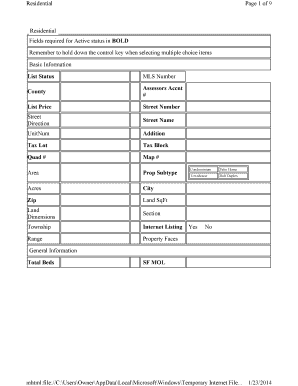

How to fill out sss loan application form

How to fill out PH SSS Member Loan Application

01

Obtain the PH SSS Member Loan Application form from the SSS website or your nearest SSS branch.

02

Fill out the personal information section, providing your name, address, contact details, and SSS number.

03

Indicate the type of loan you are applying for (e.g., salary loan, calamity loan).

04

Provide your employment information, including employer's name, address, and contact number.

05

Specify the loan amount you are requesting and the purpose of the loan.

06

Attach required documents, such as proof of income and any additional documents stipulated in the form.

07

Review all entries for accuracy and completeness before submission.

08

Submit the completed application form and documents to your local SSS branch or through an authorized representative.

Who needs PH SSS Member Loan Application?

01

Members of the SSS who require financial assistance for personal needs, such as medical expenses, education, home improvements, or emergencies.

02

Employed individuals who have made sufficient contributions to their SSS account and meet the eligibility criteria for loans.

Fill

sss loan application online

: Try Risk Free

People Also Ask about sss loan online

How can I qualify for SSS salary loan?

All currently employed, currently contributing self-employed or voluntary member. For a one-month loan, the member-borrower must have thirty six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.

How is SSS first salary loan calculated?

LOAN AMOUNT A two-month salary loan is equivalent to twice the average of the member-borrower's latest posted 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

How much is the first SSS salary loan?

Another simple computation to look at would be, if you have posted 36 monthly contributions, of which six has been within the last 12 months before submitting your application, you can loan up to PHP 15,000 or a one-month salary loan. This is also the usual amount that first-time borrowers can receive (minus taxes).

What is loanable amount in SSS?

LOANABLE AMOUNT Actual need of the borrower (total project cost) Loan value of the assigned collateral or securities; or. Maximum of P500. 00 million per borrower.

How can I apply for SSS salary loan online disbursement?

Log in to your SSS online account and then tap on the “E-Services” button. When you press “Apply for Salary Loan,” it will prompt you to enroll a disbursement method under their Disbursement Account Enrollment Module. You need to do this first before applying for any loan or benefit.

How many days does SSS salary loan release?

The loan proceeds shall be available to member-borrower's account within three (3) to five (5) working days from approval date of the loan. The salary loan proceed is accessible through any Megalink, Bancnet and Expressnet Automated Machines. 6.

Can I apply SSS loan online application form?

SSS can submit the salary loan application online. The salary loan submitted online by an employed member will be directed to the employer's My. SSS account for certification, hence, the employer should also have an SSS Web account.

Can I apply SSS loan now?

Members with at least 36 months of total contributions, six months of which have been posted in the last 12 months (before the month of application) can apply for a loan in SSS.

What is the maximum SSS salary loan?

Anyway, since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month salary loan, and Php 50,000 for a two-month salary loan.

How much is the 1st loan in SSS for salary loan?

LOAN AMOUNT A two-month salary loan is equivalent to twice the average of the member-borrower's latest posted 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

Can I apply for SSS salary loan online?

The good news is SSS has made its salary loan application more convenient with just a few clicks online.

How many percent is the first loan in SSS?

The loan shall be charged an interest rate of ten percent (10%) per annum until fully paid, based on diminishing principal balance, and shall be amortized over a period of 24 months.

How much can I borrow from SSS for the first time?

Anyway, since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month salary loan, and Php 50,000 for a two-month salary loan.

How much can I borrow SSS salary loan?

Anyway, since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month salary loan, and Php 50,000 for a two-month salary loan.

What is one month salary loan in SSS?

All currently employed, currently contributing self-employed or voluntary member. For a one-month loan, the member-borrower must have thirty six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.

How can I apply for my SSS loan?

Application Requirements Member Loan Application Form. SSS digitized ID or E-6 (acknowledgement stub) with any two valid IDs, one of which with recent photo. Unexpired Driver's License. Professional Regulation Commission (PRC) ID card. Passport. Postal ID. School or Company ID. Tax Identification Number (TIN) card.

How much is my first loan in SSS?

A two-month salary loan is equivalent to twice the average of the member-borrower's latest posted 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sss loan apply online from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your sss online loan application form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in sss online loan application without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your sss loan form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete sss loan application form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your how to apply sss loan online. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is PH SSS Member Loan Application?

The PH SSS Member Loan Application is a formal request submitted by members of the Social Security System (SSS) in the Philippines to access various types of loans provided by the SSS, including salary loans, calamity loans, and others.

Who is required to file PH SSS Member Loan Application?

Members of the Social Security System (SSS) who wish to avail of loans such as salary loans, calamity loans, and other financial assistance programs are required to file a PH SSS Member Loan Application.

How to fill out PH SSS Member Loan Application?

To fill out the PH SSS Member Loan Application, members must provide personal information, loan details, and other relevant information as outlined in the application form. It is important to ensure that all information is accurate and complete.

What is the purpose of PH SSS Member Loan Application?

The purpose of the PH SSS Member Loan Application is to enable members to apply for financial assistance through loans that can help cover unforeseen expenses, improve their financial stability, and support their needs during emergencies.

What information must be reported on PH SSS Member Loan Application?

The information that must be reported on the PH SSS Member Loan Application includes personal details such as name, SSS number, contact information, employment details, loan amount requested, purpose of the loan, and any other information as required by the application form.

Fill out your PH SSS Member Loan Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sss Salary Loan Form is not the form you're looking for?Search for another form here.

Keywords relevant to sss loan online application form

Related to online calamity loan sss

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.