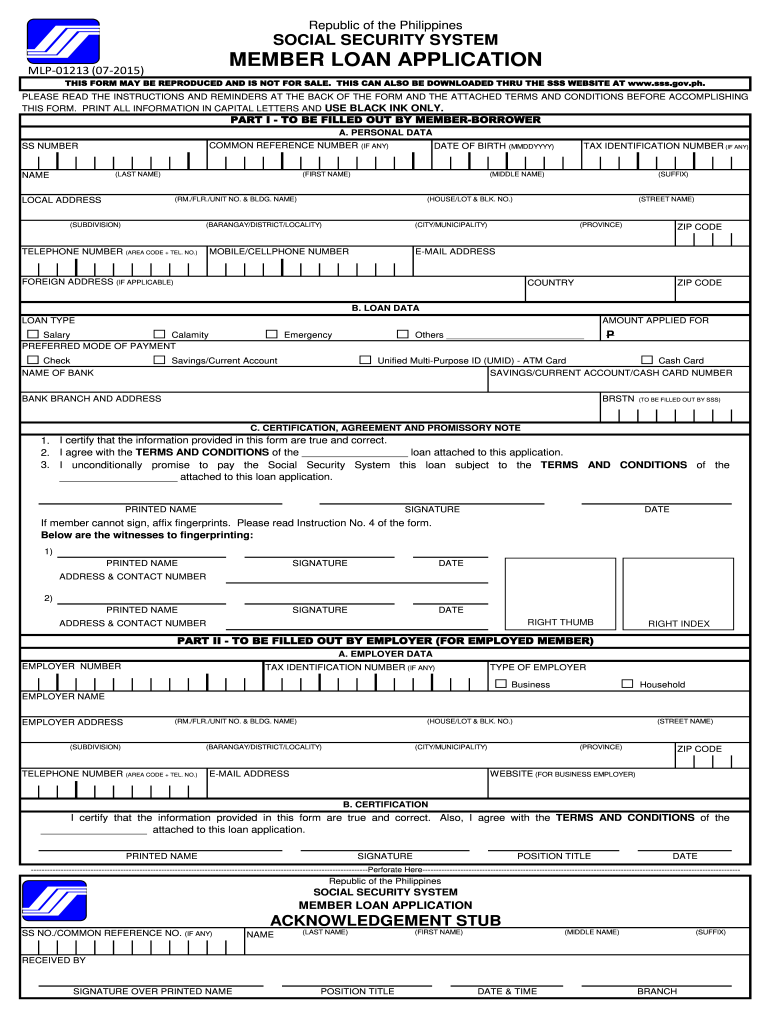

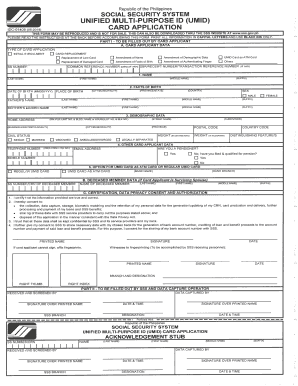

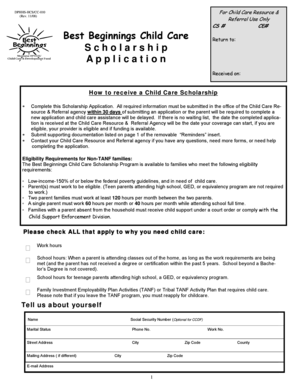

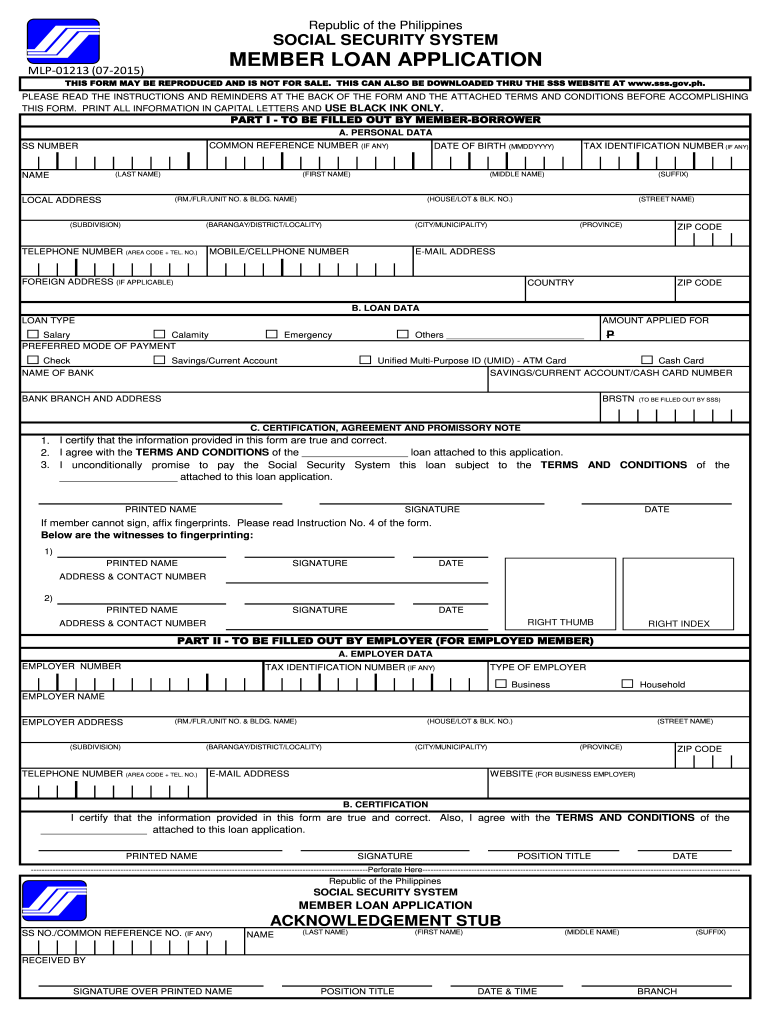

PH SSS Member Loan Application 2015-2025 free printable template

Get, Create, Make and Sign sss loan form

Editing sss member application form online

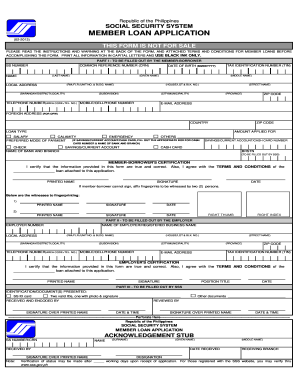

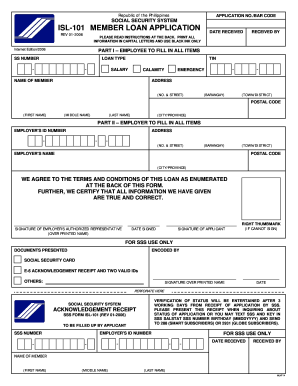

PH SSS Member Loan Application Form Versions

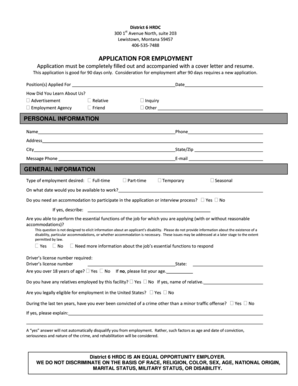

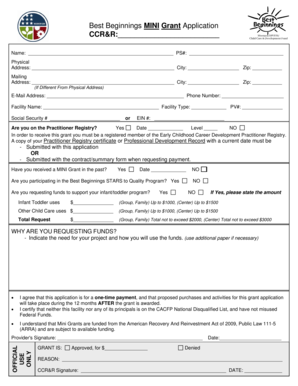

How to fill out sss loan form downloadable

How to fill out PH SSS Member Loan Application

Who needs PH SSS Member Loan Application?

Video instructions and help with filling out and completing salary loan form

Instructions and Help about apply for loan online sss

Hi my name is Janice from Piney investor calm today I'm going to show you how to apply for SSS salary loan online in my previous videos I showed how to register for your SSS online account and on the other video I showed you how to check your SSS contributions online laying the money Papal Tahoma information about salary loans and how to apply for salary loan through their website actually I Fate Okinawa is because Arab pardon and India where no American facility SSS online where we can apply for salary loans non-Indian a nightingale informal Tessa branch, and we also have a lot of tutorials on YouTube at SSS website oom-pah-pah no go into pro Miami parent Angela Moore Miami / in Hindi NASA kit animal tutorials NATO, so I hope K-pop on Omaha — long videNATOto parvellumum a new young local saloons Long SSS at how to apply for salary loans ok so let's start, so this is the official website of SSS very show corner and boom pop ANOVA appointment as a website, so first we need to have an internet browser so right now I'm using Internet Explorer because that's what they recommend, so I'm going to open a new tab, and I'm going to type SSS that go of that TH okay, so this is the official website of the Philippine social security system so sub H net auditors at the as Anita Yuma menus, so I'm going up in the netting islands Ga zeta Yokohama nothing so loans member loans and then salary loans okay click on align your salary alone okay so page 808 oh you mean overview now loans, so salary loans overview, so it tells us now and salary loan is a cash loan granted to unemployed currently paying employed or voluntary member, so it is intended to meet the members short-term credit needs, but it's overview long toe, so you next tab either young eligibility requirements beacon ABBA Satin Biscay nearly long if you have timed everything is here in Amman and on the third tab it's how to apply so indeed EMI application requirements and filing procedures so Randi Tallahassee on-air clicking lay on how to apply embed messaging in an animal application requirements at lot number who the fourth tab is loan details so Dino my kit anew young loan amount you more information than repayment term and schedule of payment in they cannot involve a scientist I Bahama gamma Taipei so my interest and penalty then service fee loan renewal responsibilities of employer responsibility of member borrower deduction event paid loan from benefits and other conditions so Latin and Ito Assani Ella okay so yeah an information now tail animal Amino before Kamala apply for the salary loan not offering and SSS so tt9 ID token palace or qualified Pocono pork on coulomb fine Hindu log now or go and open gala onion go in or omit para ma qualify to apply for a salary known okay so once the bass onion again we will then go back to the main page or your home page young Philippine social security system the website at the UN and assuming the marinade on user ID and password no cop agree adjuster in...

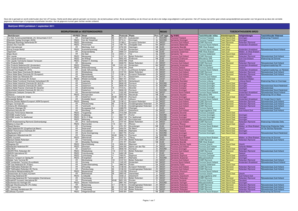

People Also Ask about sss loan application form 2023

How can I qualify for SSS salary loan?

How is SSS first salary loan calculated?

How much is the first SSS salary loan?

What is loanable amount in SSS?

How can I apply for SSS salary loan online disbursement?

How many days does SSS salary loan release?

Can I apply SSS loan online application form?

Can I apply SSS loan now?

What is the maximum SSS salary loan?

How much is the 1st loan in SSS for salary loan?

Can I apply for SSS salary loan online?

How many percent is the first loan in SSS?

How much can I borrow from SSS for the first time?

How much can I borrow SSS salary loan?

What is one month salary loan in SSS?

How can I apply for my SSS loan?

How much is my first loan in SSS?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sss application form download from Google Drive?

How do I make edits in sss loan application online without leaving Chrome?

How do I complete forms of sss on an iOS device?

What is PH SSS Member Loan Application?

Who is required to file PH SSS Member Loan Application?

How to fill out PH SSS Member Loan Application?

What is the purpose of PH SSS Member Loan Application?

What information must be reported on PH SSS Member Loan Application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.